All Categories

Featured

Table of Contents

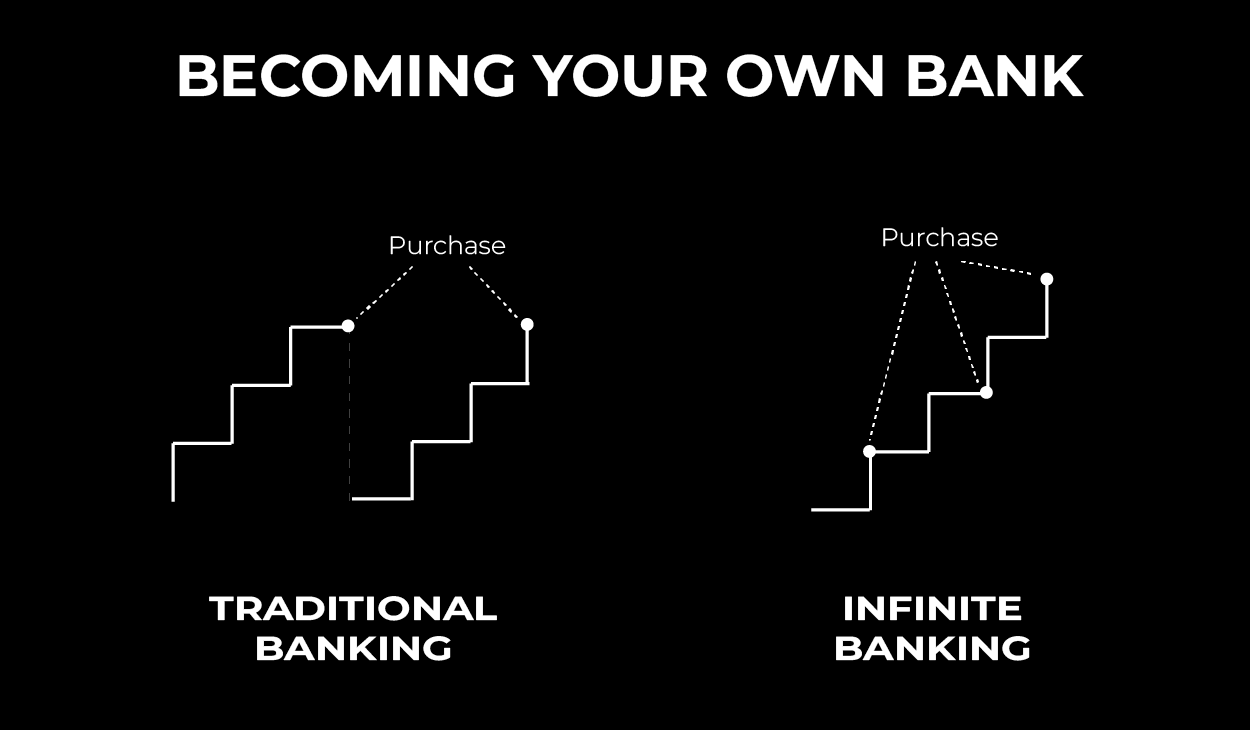

The approach has its own advantages, however it additionally has concerns with high charges, intricacy, and much more, resulting in it being considered as a rip-off by some. Limitless financial is not the most effective policy if you require only the financial investment component. The unlimited financial concept revolves around making use of entire life insurance policies as a monetary tool.

A PUAR enables you to "overfund" your insurance plan right up to line of it becoming a Changed Endowment Contract (MEC). When you use a PUAR, you rapidly increase your money value (and your survivor benefit), therefore raising the power of your "financial institution". Even more, the more cash worth you have, the greater your passion and reward payments from your insurer will be.

With the increase of TikTok as an information-sharing platform, financial advice and approaches have located an unique means of dispersing. One such method that has actually been making the rounds is the boundless banking idea, or IBC for brief, garnering recommendations from celebs like rap artist Waka Flocka Fire - Policy loan strategy. While the method is currently prominent, its roots trace back to the 1980s when financial expert Nelson Nash introduced it to the globe.

How long does it take to see returns from Financial Independence Through Infinite Banking?

Within these policies, the money worth expands based on a price established by the insurance provider. As soon as a significant cash value gathers, insurance holders can obtain a cash value finance. These loans vary from traditional ones, with life insurance coverage working as security, suggesting one can lose their protection if borrowing exceedingly without appropriate cash value to support the insurance prices.

And while the allure of these plans is noticeable, there are inherent limitations and threats, necessitating diligent money value tracking. The technique's authenticity isn't black and white. For high-net-worth individuals or entrepreneur, especially those making use of approaches like company-owned life insurance (COLI), the advantages of tax breaks and compound development can be appealing.

The allure of infinite financial doesn't negate its challenges: Expense: The fundamental need, an irreversible life insurance policy policy, is costlier than its term equivalents. Qualification: Not every person gets entire life insurance policy due to rigorous underwriting procedures that can leave out those with details health or way of life problems. Intricacy and risk: The detailed nature of IBC, combined with its risks, might hinder many, especially when easier and much less high-risk choices are offered.

How does Financial Leverage With Infinite Banking create financial independence?

Alloting around 10% of your month-to-month revenue to the policy is just not feasible for many people. Part of what you review below is simply a reiteration of what has currently been said above.

Prior to you obtain on your own into a scenario you're not prepared for, recognize the complying with initially: Although the concept is typically offered as such, you're not really taking a car loan from on your own. If that held true, you wouldn't have to repay it. Instead, you're borrowing from the insurance business and have to settle it with passion.

Some social media blog posts suggest using cash worth from entire life insurance policy to pay down credit card financial debt. When you pay back the financing, a section of that passion goes to the insurance policy company.

How do I optimize my cash flow with Infinite Banking Retirement Strategy?

For the initial numerous years, you'll be repaying the compensation. This makes it incredibly difficult for your policy to collect worth throughout this moment. Whole life insurance policy prices 5 to 15 times more than term insurance policy. Many individuals just can not afford it. So, unless you can pay for to pay a couple of to numerous hundred dollars for the next decade or even more, IBC will not benefit you.

Not everybody needs to count solely on themselves for economic safety. Infinite Banking concept. If you need life insurance coverage, right here are some valuable pointers to take into consideration: Take into consideration term life insurance. These plans offer insurance coverage during years with considerable economic obligations, like home mortgages, trainee financings, or when looking after children. Make sure to go shopping about for the very best price.

What happens if I stop using Borrowing Against Cash Value?

Think of never ever needing to worry concerning small business loan or high rates of interest again. Suppose you could obtain cash on your terms and develop wealth at the same time? That's the power of infinite banking life insurance. By leveraging the cash money worth of entire life insurance policy IUL policies, you can grow your wide range and obtain cash without depending on typical financial institutions.

There's no set finance term, and you have the liberty to choose the settlement routine, which can be as leisurely as repaying the financing at the time of death. This adaptability extends to the servicing of the fundings, where you can go with interest-only repayments, maintaining the lending balance flat and manageable.

What are the risks of using Infinite Banking Benefits?

Holding cash in an IUL repaired account being credited rate of interest can commonly be far better than holding the money on deposit at a bank.: You have actually constantly fantasized of opening your own pastry shop. You can borrow from your IUL policy to cover the preliminary costs of leasing an area, purchasing devices, and employing team.

Individual fundings can be acquired from conventional financial institutions and cooperative credit union. Here are some key points to take into consideration. Bank card can supply a flexible way to borrow money for very temporary durations. However, obtaining money on a charge card is normally really costly with annual percentage rates of interest (APR) frequently getting to 20% to 30% or more a year.

Latest Posts

Private Banking Concepts

Infinite Financial Group

Become Your Own Bank