All Categories

Featured

Table of Contents

If you take a circulation versus your account before the age of 59, you'll likewise have to pay a 10% fine. The internal revenue service has imposed the MEC policy as a method to stop individuals from skirting tax obligations. Unlimited financial only works if the cash value of your life insurance coverage policy remains tax-deferred, so make sure you do not turn your plan into an MEC.

As soon as a cash value insurance account categorizes as an MEC, there's no means to reverse it back to tax-deferred condition. Boundless financial is a feasible idea that offers a range of advantages.

You can profit of limitless banking with a variable global life insurance coverage policy or an indexed universal life insurance policy plan. Given that these types of plans tie to the supply market, these are not non-correlated properties. For your plan's cash value to be a non-correlated possession, you will need either entire life insurance or universal life insurance coverage.

Before selecting a policy, locate out if your life insurance policy business is a common company or not, as just shared business pay rewards. You won't have to dip into your financial savings account or search for lenders with low-interest rates.

How flexible is Leverage Life Insurance compared to traditional banking?

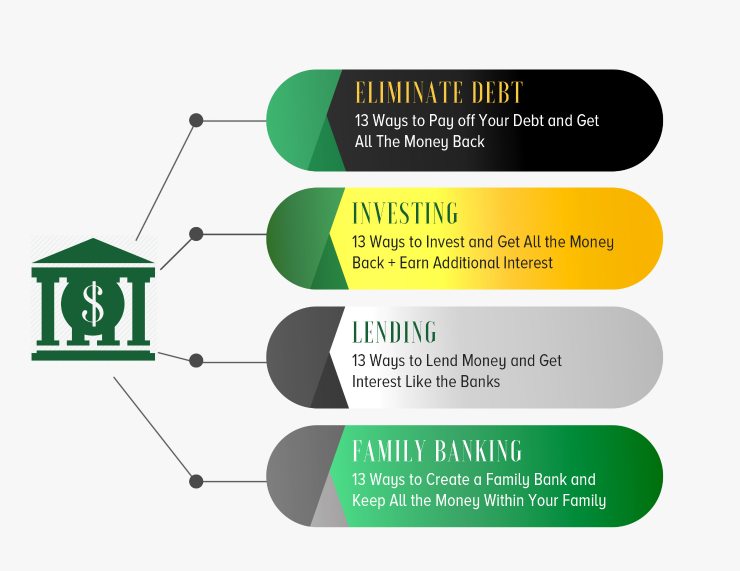

By taking a funding from you in contrast to a standard lender, the borrower can save hundreds of bucks in passion over the life of the financing. (Simply make sure to charge them the exact same rate of rate of interest that you need to pay back to yourself. Otherwise, you'll take a monetary hit).

Because of the MEC regulation, you can not overfund your insurance policy as well much or as well quickly. It can take years, if not decades, to build a high money worth in your life insurance policy.

A life insurance coverage policy ties to your wellness and life expectations. Depending on your clinical background and pre-existing conditions, you might not qualify for a permanent life insurance plan at all. With infinite banking, you can become your very own lender, borrow from yourself, and add money worth to a permanent life insurance coverage plan that grows tax-free.

When you first become aware of the Infinite Financial Idea (IBC), your initial response could be: This sounds too good to be real. Probably you're unconvinced and believe Infinite Financial is a scam or system. We want to set the document right! The trouble with the Infinite Banking Idea is not the concept however those individuals providing an unfavorable critique of Infinite Financial as an idea.

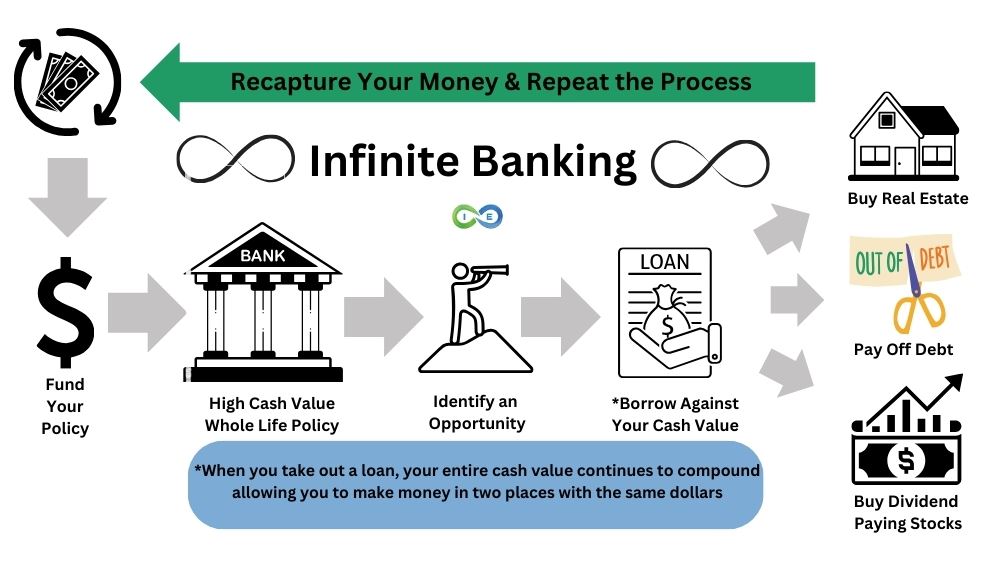

So as IBC Authorized Practitioners via the Nelson Nash Institute, we believed we would respond to a few of the top inquiries people look for online when learning and recognizing every little thing to do with the Infinite Banking Principle. What is Infinite Banking? Infinite Banking was produced by Nelson Nash in 2000 and fully discussed with the publication of his publication Becoming Your Own Lender: Unlock the Infinite Financial Idea.

How do I leverage Infinite Banking For Financial Freedom to grow my wealth?

You believe you are coming out financially ahead due to the fact that you pay no interest, however you are not. With saving and paying cash money, you might not pay rate of interest, however you are utilizing your money once; when you invest it, it's gone for life, and you offer up on the chance to make lifetime substance rate of interest on that cash.

Billionaires such as Walt Disney, the Rockefeller household and Jim Pattison have leveraged the residential or commercial properties of entire life insurance coverage that dates back 174 years. Also banks use whole life insurance coverage for the very same purposes.

What type of insurance policies work best with Whole Life For Infinite Banking?

It allows you to create wealth by fulfilling the banking function in your own life and the capacity to self-finance major way of living purchases and costs without interrupting the compound rate of interest. One of the simplest ways to think of an IBC-type participating entire life insurance policy policy is it is similar to paying a home mortgage on a home.

With time, this would produce a "consistent compounding" impact. You obtain the photo! When you obtain from your getting involved whole life insurance policy plan, the cash value continues to grow uninterrupted as if you never ever obtained from it in the very first area. This is since you are utilizing the money value and fatality benefit as security for a finance from the life insurance policy firm or as collateral from a third-party lender (called collateral financing).

That's why it's critical to collaborate with a Licensed Life insurance policy Broker accredited in Infinite Banking who frameworks your participating entire life insurance policy policy appropriately so you can avoid negative tax obligation ramifications. Infinite Banking as a monetary method is except every person. Below are several of the advantages and disadvantages of Infinite Banking you must seriously take into consideration in making a decision whether to progress.

Our recommended insurance coverage carrier, Equitable Life of Canada, a shared life insurance coverage company, focuses on getting involved whole life insurance policy policies certain to Infinite Financial. In a mutual life insurance business, policyholders are taken into consideration company co-owners and receive a share of the divisible excess generated annually through rewards. We have a range of service providers to pick from, such as Canada Life, Manulife and Sunlight Lifedepending on the demands of our customers.

What happens if I stop using Infinite Banking Wealth Strategy?

Please additionally download our 5 Leading Questions to Ask An Unlimited Banking Agent Before You Employ Them. To learn more concerning Infinite Banking visit: Please note: The product supplied in this newsletter is for informational and/or educational functions just. The info, point of views and/or sights revealed in this newsletter are those of the authors and not always those of the distributor.

Latest Posts

Private Banking Concepts

Infinite Financial Group

Become Your Own Bank